Unfortunately, Inheritance Tax comes at a time when we are already having to cope with the grief of a lost loved one and having to think about this tax is a major stress to compound this. In addition, it’s a tax where some planning can be done via some simple measures if your loved one

Author Archives: Gillian French

Thinking about moving your investment property into a limited company? You’re not alone! Many UK landlords are considering this move and in fact recently some of our clients have been doing just that. Let’s break down the practical stuff and the tax consequences so you can make an informed decision. Practical Stuff 1.Setting

What Are Payments on Account? The payments on account system is designed for people with untaxed income sources like the self-employed, partners in partnerships, or those with investment, rental, or dividend income. Unlike PAYE (Pay As You Earn) where tax is taken directly from your salary or pension each month, these payments cover income that

As an ambitious entrepreneur, you often feel like there aren’t enough hours in the week. You’re busy with running the day-to-day operations, managing team members and, well, life. It means you’re left with little time to stop and consider how you can save on tax. Yes, tax can be an absolute minefield if you’re unprepared,

What is MTD we hear you ask? No, it’s not “Month to Date”, “Metric Tonnes per Day” or even “Marine Technology Directorate”! We’re talking about Making Tax Digital. The scheme was originally announced by HMRC in 2017, but it’s been years in the making (a bit like Avatar 2!). What’s changing? MTD will require

Starting a new business is rewarding, but it certainly comes with its challenges…to put it lightly! You’ve often got to contend with circumstances completely out of your control, all while spinning what feels like a hundred plates to manage the day-to-day. Although setting up a new business takes major legwork, there are key processes you

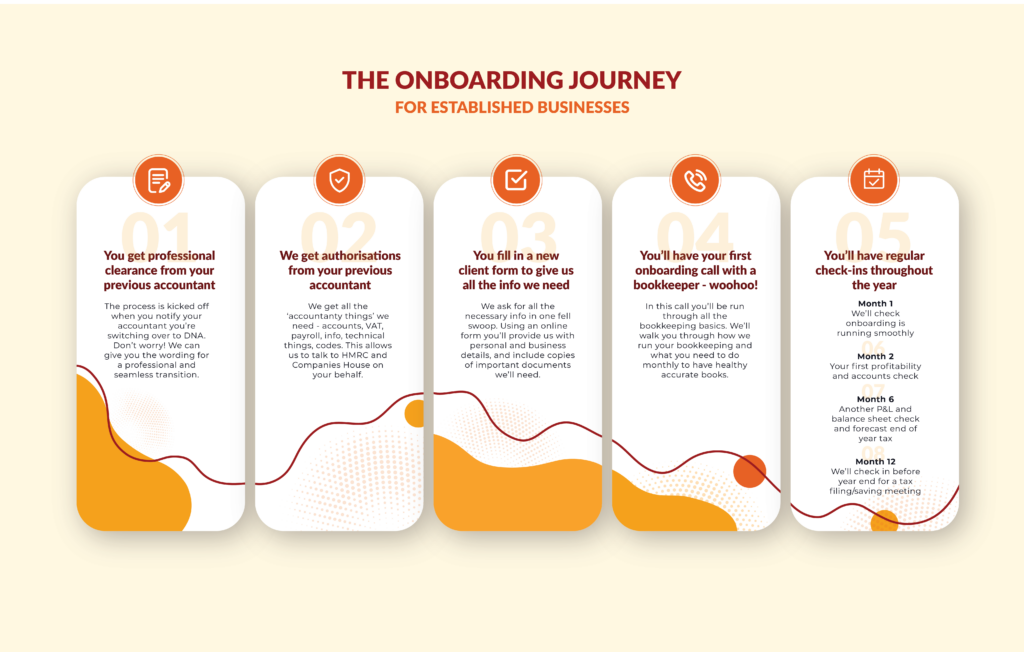

You’ve made the decision to switching accountants but are filled with a number of worries about the whole process. Have a read of this article, allow us to (virtually) hold your hand and work through some of your worries. Believe me, after 20 plus years, we’ve seen it, done it and navigated hundreds of new

Xero is the UK’s leading accounting software, and here at DNA we’re big fans. We discovered it ten years ago, and quickly found it was worlds above anything we’d used before! We started recommending it to our clients, and now pretty much everyone we work with is on it (and the handful who aren’t are

Here at DNA, we don’t believe in spreading ourselves thin. We focus on what we’re good at, and on doing it really well, because our clients deserve thorough, dependable support. It’s for this reason we now only work with limited companies (they’re kind of our thing). With over 20 years experience in limited companies, we

We have been around long enough to have taken on clients who have previously been using large firms, predominantly for the prestige. Big isn’t always best Here are some of their comments about these larger firms: We felt like we were small fish in large pond Our day to day work had been delegated to